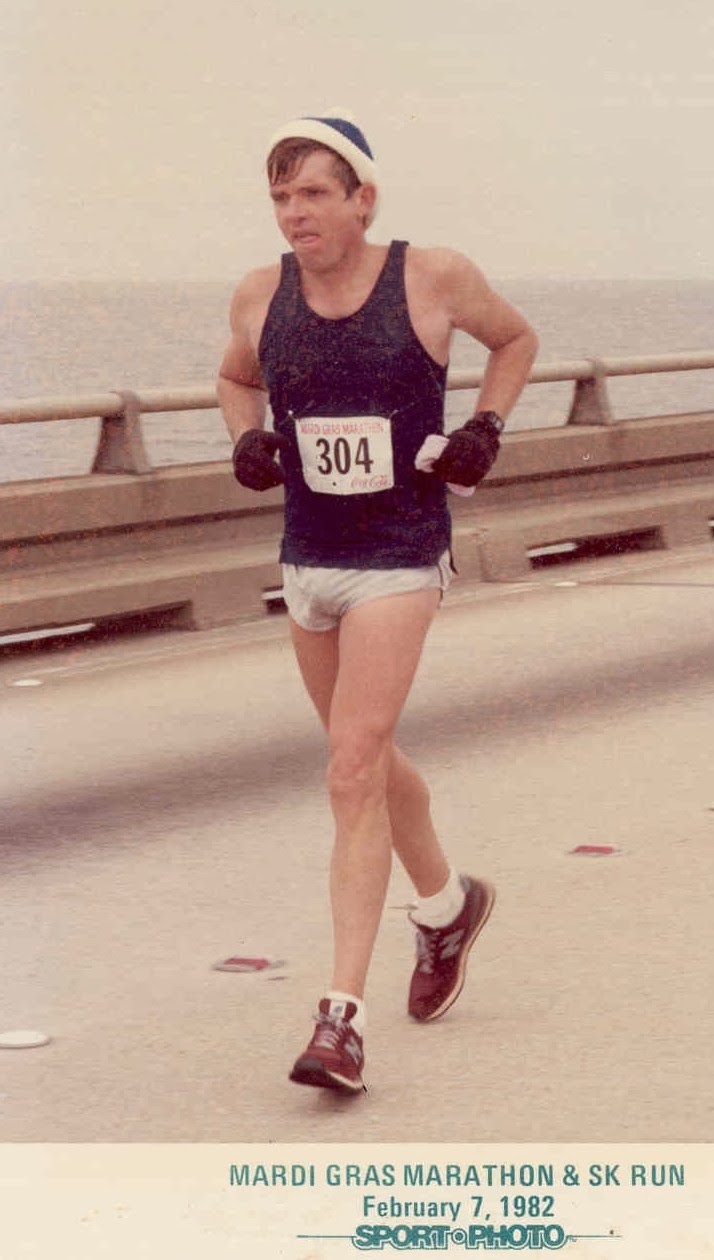

by Bert Carson

Today I'm sending the rest of

Lessons Learned, to my editor. She already has the first fifteen of forty-three chapters—in fact, I'm sure she is draped around a cup of coffee starting chapter one while I'm telling you this story, which is sort of related, but has nothing to do with me getting the rest of the chapters to her today. So I have to make this short.

Lessons Learned is the story of the effect of war on those who participate in it. It grew, from what I thought was going to be a simple writing exercise, into a book that is already on the way to becoming a series of books called the

Sam and Jan Jordan Series.

I finished the first draft of

Lessons Learned last week and immediately started book two,

We Have A Call. Four chapters into it, I realized that I had to know about Mississippi casinos: how they operate, their financial picture, how to get a license to build one, and, though not directly related, money laundering.

That need for knowledge prompted me to Google "casino financial statements," which led me to a number of corporate financial statements. Among the statements was Leucadia National's 2012 Annual Report. A quick scan led to the profound discovery that all great stories aren't told in books, or short stories, or screen plays, or even around gypsy campfires.

At least one is in

Leucadia's 2012 Annual Report.

Following is the beginning and the end of the eighteen page message to stockholders, which you can read in its entirety

here.

To Our Shareholders - The

Last Hurrah

Forty-three years ago, the two of us met at

Harvard Business School and thirty-five years ago was the beginning of a

remarkable partnership — the results of which are tabulated on the opposite

page. The end of 2012 marks the end of this partnership and the last letter

from the two of us. In terms of financial results, 2012 was also our most

successful year. Earnings before tax for 2012 were $1.371 billion, a record.

For the next few pages we propose an

incomplete trip down memory lane, let’s call it an unofficial history, mostly

written for the benefit of grandchildren, but we hope our long time shareholders

will enjoy it as well.

After graduating from Harvard Business School

in 1970, we began working together at a small family owned investment bank with

the curious name of Carl Marks and Company. One of us left for an adventure out

west and our paths diverged. We were reunited when one of us surfaced in

pursuit of Talcott National Corporation, the holding company for an old, but

moribund financial services company that became embroiled in businesses about

which they knew little and was almost insolvent. One of us was a reluctant

joiner to the rescue of Talcott and regarded the prospects of success as

unlikely. The other, being more enthusiastic, optimistic and in need of a

challenge and a paycheck plunged full speed ahead and after a year of urging

got the other to sign up for the task. This was the beginning of the

partnership which would become Leucadia.

Our backers were our old colleagues from Carl

Marks for which we are forever grateful. It took another year of cajoling all

two hundred plus creditors, numerous flights to Chicago, Los Angeles and, of

all places, Baton Rouge, to convince the last creditor to sign on. And finally, in

April 1979, an out of court reorganization, probably one of the most

complicated even to this day, was successfully completed.

Talcott entered reorganization with a

negative $8 million book value and emerged with a book value of $23 million. We

restructured the company, hunting and recovering value among a hodgepodge of

operating businesses and financial assets. Little did we know, this approach would

become de rigueur for the next

thirty-five years.

In the course of this adventure we met our

now old friends, Tom Mara, our Executive Vice President who preceded us at

Talcott, along with Steve Jacobs and Andrea Bernstein who became our lawyers

and advisers and remain so to this day. We

relinquished the name Talcott in 1980 with the sale of James Talcott Factors to

Lloyds and Scottish, a UK based factoring company. We struggled to find a new

name — every idea we surfaced was either already taken or rejected by

regulators. Adding to the urgency was the SEC’s growing impatience with the

blank line at the top our letterhead. One afternoon we were driving north on

the San Diego Freeway and happened upon the town of Leucadia, California. Why

not? The name was available and we liked

the sound of it. One of our mothers thought it a blood disease. But, it looked

great on that interstate exit sign and has served us well.

As we conclude this final epistle and wrap up

our extraordinary working relationship, we find ourselves reflecting on

Leucadia’s formidable past and promising future. A 35 year partnership is rare

in marriage and even rarer in business. Those unfamiliar with our approach have

sometimes been startled by the occasional tenacity of our interactions. We are

both strong personalities with correspondingly strong opinions. Each of us has

been described as “often wrong, but never in doubt.”

We frequently saw a deal differently or

disagreed on the strategic course of an operating company — the alchemy of our

partnership enabled us to resolve our differences. We trust one another and

respect the value of our differing skills, interests and intuitions.

Over the last 35 years we have unfailingly

stood by one another in times of heartache, health and personal challenges. Our

relationship means more to us than we easily acknowledge. We owe a special debt

to our families who were often neglected while we chased the next deal. We are

both blessed with loving wives and children who have risen above our excesses

and absences to make us very, very proud.

One of us remains to do all he can to help

Rich and Brian take Leucadia to new heights. The other will be cheering – and

kibitzing – from the sidelines and building a private family company. Managing

Leucadia has been a magnificent adventure. We have done well and so have our

shareholders. It has given us great pleasure to meet shareholders and to learn

that proceeds from the sale of Leucadia stock sent their kids to college. None

of this would have been possible without the hard work, devotion, courage and

enthusiasm of our Directors, employees and advisers.

Thank you. Ian M. Cumming and Joseph S. Steinberg

There is at least a five novel series in the eighteen page statement to Leucadia's Stockholders. The name of the book series is even supplied in the history of the company: Often Wrong But Never In Doubt.

Since the Sam and Jan Jordan Series is going to keep me tied up for the next few years, the Never In Doubt Series is yours if you want it. Whether you do or do not, join me in wishing Ian and Joseph a happy retirement.

Okay Rebecca. Okay. I'm going back to work right now.